Best Investment Apps For Students And Beginners

Disclosure: This post may include affiliate links and images that we may receive compensation if you click on the link and purchase, at no cost to you.

Updated 01/01/2023

Are you actively searching for the best investment apps for beginners to build different smart passive income ideas?

Whether you are an investing beginner or an intermediate trader, you need to conduct research to identify the best free stock trading app, which you can have peace of mind to save money and invest in the long run.

Depending on each individual expectation, you may choose the appropriate one to get the most benefit out of it.

As you are all aware, the current extreme market volatility is influenced by the influx huge number of new traders and investors into the market, which caused stiff competition among investing brokers in getting new customers to their trading platform.

For this reason, investing beginners and even intermediate ones are struggling to find the best trading app in order to support their long-term commitment to investing. For example, if you are a student and saving costs is your main priority, then finding a free-trading app is the appropriate answer.

With these trading apps for beginners, you can check your portfolio performance, and portfolio stocks and send money in and out of the account without communicating with the service desk. As long as have selected available online payment options on their platform to receive money.

In this article, we are going to explore different best investment apps for beginners in terms of fees and features, so that you can make an informed decision to select the right investment platform and achieve long-term money goals.

Key points

Table of Contents

- Robinhood is– Best Free Stock Trading App, which offers no minimum requirement for a deposit.

- Acorns– Best Free Saving and investing App for Students, who want to save money and invest spare changes in the long term.

- Interactive Broker– Best Free Stock Trading App for short and long-term investors-International Investors, it also lets investors trade cryptocurrencies like Bitcoin, Ethereum, etc. ( Best Share Market App)

- WealthFront– Best For Tax Saving and Using Robo Advisors.

- M1 Finance– Best for Individual Investors, who plan to invest in the long run by automated investing over time. It offers a free trading fee for members.

- Vanguard– Best for Investing in Index Funds and Mutual Funds (Best Mutual Fund App for long-term investors)

- Etoro– Best Day Trading App for Cryptocurrency.

- E-Trade– best trading apps for beginners and active traders

Here are additional reading materials that are related to personal finance and investing:

> Best Budgeting Tools for Millennials in 2023

> Personal Capital Review: Is It The Best Free Budget App?

1. Robinhood

Robinhood is the first name on the list of best investment apps due to the fact that it has a huge number of beginning investors and experienced traders on the platform.

Importantly, it’s a totaling free trading app, where Robinhood offers a free trading fee for members, even if you plan to trade more than 30 to 40 times per month- the answer is still the same- completely commission-free trading app.

Robinhood is the best investment and stock trading platform for individuals who want to pay a free commission from their trading activities.

Can you find the cheapest stocks on Robinhood?

Another great benefit of this app is the variety of assets and international equities for investing. such as users can get access to invest in ETFs, mutual funds, and individual stocks for their own investment benefits.

For this reason, day traders or investors can always find a cross-range of investing stock market products, where they have the option to search for the cheapest stocks on Robinhood.

If you do proper research and preparation in terms of choosing the best penny stocks on Robinhood, then the chance of finding quality stocks is depended on your hard work and commitment.

Basically, investors do not need a requirement to deposit money upon opening an account with Robinhood. In other words, they charge $0 commission trades and $0 account minimum as it saves traders for long-term trading activities, especially for day traders.

What things I don’t like about Robinhood?

Robinhood doesn’t provide any retirement account, which investors may use to create long-term financial goals for their needs.

The app will automatically charge a monthly fee for margin lending service and maintenance fees. if you plan to move your account to another trading app, then you have to pay initial fees of around $75 (Source, Wall Street Journal, 2018).

2. Acorns

Acorns is another best investment app on the list. Why? because it is an ideal solution for beginning investors to dive deep into the stock market and it doesn’t require any minimum deposit upon opening the account.

In addition, if you plan to invest in achieving long-term financial goals or retirements, this micro-investment app is for you due to the fact that you can use the app to save and invest over time.

Acorns also have a huge number of stocks, commodities, and other international asset classes across the world such as ETFs, Bitcoin ETFs, equities, index funds, and mutual funds.

Importantly, Acorns offers passive investing in ETFs and other communities for students to use their saved money and invest in the long term ( best investment apps).

What things I don’t like about Acorns?

Those with a smaller account, especially students, may get charged a flat fee of between $2 to $3 a month for maintaining the account.

Related reading: Acorns Review 2023: Features and How It Works

3. Interactive Brokers

Interactive Brokers is the next best investment app on the list because it offers a low-commission trade for active traders and investors.

In addition, if you plan to invest in cryptocurrencies as part of your diversified investment portfolio, then Interactive broker has an option for you to invest in Bitcoins.

In particular, members are able to invest in four main cryptocurrencies like Bitcoin, Ethereum, etc.

Moreover, the platform has an advanced trading platform, where users can access a cross range of shares, stocks, ETFs, and mutual funds, which include international stocks and exchange-traded funds.

For example, you can use the Interactive broker investing app to access the Singapore stock market by investing in ETFs or individual stocks.

Another great benefit of using this best-day trading app is the low margin rates, where it charges a low fee for trading through margin. 0% commission fee on trade as customers are free to execute orders for their own benefit, especially active and casual traders.

The account minimum requirement is $0 upon opening with Interactive Brokers. In other words, the trading app offers a 0$ requirement for opening the account, and of course free opening an account with Interactive Brokers too.

Therefore, Interactive Broker is considered the best share market app-stock investing app for share trading.

What things I don’t like about Interactive Brokers?

The platform is hard to use in terms of searching for stocks and managing your own portfolio. You require a bit of time to get familiar with the app.

It charges an inactivity fee for a pro trader or long-term trader if you are not executing any trade during a quarter.

4.WealthFront

WealthFront is another best investment app that offers a low cost to multiple investment products. For example, users can invest in ETFs, and international stocks, while users can access free tools like product planning tools and tax-saving strategies.

If you want to invest in the long run to achieve the long-term money goal, then consider using the WealthFront app to automate your investment over time.

In addition, the platform also provides members with the overall picture of their personal finance, in which you can highlight your current financial situation and make an improvement to achieve your long-term financial goals.

What thing I don’t like about WealthFront?

$500 is the amount required to deposit upfront in order to open an account with WealthFront.

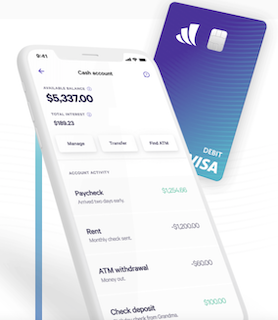

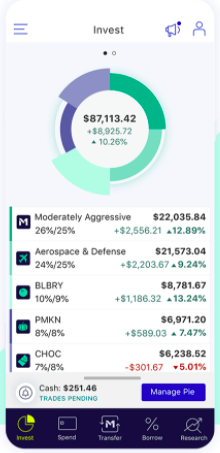

5. M1 Finance

M1 Finance is one of the best investment apps and FinTech Companies that provides a cross range of financial services, which is especially suited to individuals who want to save and invest in the long run.

The best thing about M1 Finance is it provides a free account opening and they don’t charge any commission on users’ trading activities, which includes a $0 withdrawal fee, and a $0 deposit fee.

you are not required to pay any dollars for the initial fee ( minimum initial investment fee). Therefore, it is one of the best investment apps for individuals, who would like their funds to manage by automated machine advisors- Robo advisors ( best investment apps)

What things I don’t like about M1 Finance?

Investors would need to require $100 to start investing with a regular account. It reflects the company’s aims for long-term investors.

Also for an IRA account, the initial requirement is around $500 because it is a must for opening a Roth IRA account with M1 Finance.

Read next: M1 Finance review 2023: Features & How it Works

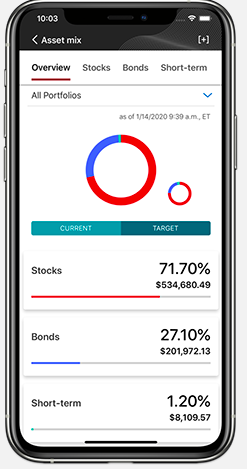

6. Vanguard

Vanguard is another best app to buy stock on the list because it provides a low-cost investment option and index funds or even mutual funds. For this reason, it is the best idea for long-term investors, who constantly invest a small percentage of their income in the app.

There is a cross-range of large mutual funds, which are best for long-term investors. Also, most of the funds are low-cost funds- you only need less than $500 to invest in a bunch of the largest companies in the US and the world in a single fund. This is because Vanguard is well positioning itself as leading in low-cost investing funds.

In terms of commission trade, you don’t need to pay a single dollar for commission trade for trading stocks, options, and ETFs. And personally, Vanguard is one of the best investment apps for beginners.

What thing I don’t like about Vanguard?

Even though Vanguard is the best trading app for long-term investors, who seek to invest on a regular basis, it is not a good choice for active investors or day traders because the platform is not designed for active trading.

There is limited data and information available on the app for trading as it makes it hard for users to monitor the particular stock.

The platform is mainly designed for investing in large mutual funds and index funds. Therefore, the platform may not suit those active traders or full-time traders.

7. Etoro

The next trading app is Etoro– the platform has a cross range of investment products, especially offers trading cryptocurrency for minimum trading of $50.

More importantly, users can use this best-day trading app to buy stocks and different crypto assets with a minimal commission fee.

Unlike other investment apps, Etoro has an innovative trading platform- it allows stock traders to learn and copy from other Etoro successful traders’ investing portfolios.

However, you need to be cautious in terms of copying a portfolio from others because it may not be applicable to your individual case as each person has their own personal financial expectations and loss of control.

In terms of fees, stock traders or investors would need to pay a fee between 0.76% to 2.8% for trading up to 15 cryptocurrencies.

What things I don’t like about Etoro? Best trading app for cryptocurrency?

There is a servicing fee for monthly or quarterly charges for active investors or casual traders.

Traders would need to pay a minimum of $50 to open and maintain an active account. This could be good if you are a day trader and the number of trades is more than 10 a month.

8. E-Trade

E-Trade is not only considered one of the best free stock trading apps with a zero commission trade. It also adds additional features such as educational resources as investors can use the tool to manage their investment portfolio.

There is a 0% commission fee for trading different sets of asset classes such as commodities, cryptocurrencies, and equities. The strong trading platform is worked best for beginner investors because it is easy to use and has many support tools to learn everything about investing.

Also, users won’t be able to pay a single dollar upon opening an account with E-trade. Therefore, it is well known as the best app to buy stocks with zero commission fee and a 0$ account minimum ( Best free stock trading app).

The platform also offers a variety of selections for investing such as stocks, options, and ETFs. Customers can gain access to investing in international stocks through E-Trade as well ( stock investment apps)

The support team is by far doing a great job to assist and answering all the concerns and inquiries from investors and traders. Hence, it is considered one of the best investment apps ( stock investment apps)

What thing I don’t like about E-Trade?

The platform can be hard to use because it has a complex cross-range of tools and trading resources available, which makes it hard for beginner investors to navigate.

Read next:

> TradingView Review 2023: Is it a reliable investing tool?