Backer Review: How The App Helps to Save Money For Kids Education-529 Plan

Disclosure: This post may include affiliate links and images that we may receive compensation if you click on the link and purchase, at no cost to you.

When saving money for your kids’ future, the first thing that comes to mind is saving for their education so they can achieve their academic goals without adding any additional student loan debt.

One of the best ways to save money for your kid’s college education is to put money to one side each month by manually using the free Google Sheets budget templates.

However, this method requires a long-term commitment to recording every daily transaction based on income and expenses. Thus, you would be able to create an effective budget and put aside money for your child’s education.

Alternatively, there are other budgeting apps like the Backer app ( formerly named CollegeBacker) that help members to find different easy ways to save money for a 529 college saving plan, and also you can invite friends and family members to contribute to the plan.

In this post, we will cover a comprehensive review of the Back app in terms of features like the 529 plan and how it works as well as pros and cons, which allow you to consider whether this budget app is the right one to start saving for your kid’s education.

Key Takeaways

Table of Contents

- Backer, formerly named CollegeBacker is one of the best college saving and budget apps, which you would consider saving for your child’s future education by maxing to 529 tax-free college saving plans.

- In addition, you can invite your friends and familiar members to contribute to the kid education fund by sending money as a gift.

- There are two options for 529 plans that you should consider applying for your child’s future: a prepaid tuition plan and a 529 saving plan.

- Generally speaking, parents can get a free Bunker plan to start saving for their kids’ education with some limitations. If you prefer more advanced features, then consider using paid subscriptions.

Here are additional reading materials that are related to money-saving tips and budgeting, if missed, you should continue to read for more information:

> Best Budget Apps to Save Money for 2023

> Personal Capital Review: Is It The Best Free Budget App?

> Acorns Review 2023: Features and How It Works

1. What is Backer app- CollegeBacker?

Backer, formerly named CollegeBacker is one of the best budget apps that specialize in providing the saving plan for a child’s future education, the 529 college saving plan.

The financial firm was established in 2016 in San Francisco. The objective is to help every family build a better financial future by using the platform to save money for their child’s future education.

At the time of writing, the saving platform has helped around $500 million dollar for families to avoid student debts ( more information about CollegeBacker here).

In particular, this saving tool continues to provide ongoing support for parents and families to stay committed to their saving plans and helps them to fund their kids’ future education.

2. How does the Backer app work?-Backer review

How to save money each month for 529 plans and college savings?

The Backer app is the ideal solution to provide the necessary tools and features that allow members to find different easy ways to save money by inviting friends and relatives members to contribute to their kid’s college fund.

It’s super important to start saving early for your child’s education by creating 529 plans because it is the one step ahead to avoiding the student debt burden and lets your child only focus on their academic learning and progress in their professional field.

One of the greatest benefits of 529 plans is the tax advantage, which means you can grow the tax-free account and withdrawal tax-free to pay for your child’s qualification expenses.

For example, members would be able to directly benefit from withdrawal tax-free such as housing, college tuition fee, books, etc.

Keep in mind that the platform would charge you a fee if you withdraw money from a 529 plan for non-qualified education expenses.

There are two options for 529 plans that you should consider applying for your child’s future:

- Prepaid Tuition plan: this plan allows members to lock in the tuition fee, but the limitation is that you are not allowed to use where you can use the fund.

- 529 saving plan: as mentioned this option provides tax benefits. However, the investment performance may not perform well at the time that you want to withdraw the fund.

3. What are the other benefits?

With the kid education program, you can invite family members and friends to send money as a gift directly to the 529 accounts in order to help grow the education fund. Thus, it will help to grow the fund faster and you can use the fund to pay for your kid’s colleges or universities.

In particular, family members and friends can contribute to the college saving funds by sending gifts for birthdays or holidays. They also have the option to make a recurring payment to help a child’s future education.

By creating customizable links, you can easily share them with families and friends to support the growth of the fund.

Another advantage that we should consider using Backer is the cashback program, which means you will earn rewards that directly contribute to your child’s education fund for shopping online using the platform links.

4. How much do you pay for Backer app premier plans?

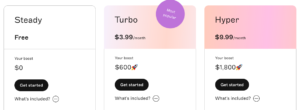

Generally speaking, there is a free Bucker plan to get started for your kid’s future education, which is called ” Steady” and the platform will allow opening one Bucker fund.

In this free plan, members will get benefits like easy sharing of the fund links and sending money as a gift for free, just to name a few. However, there is a small fee of $0.99 that applies for each time contribution.

Here is another premium Bucker plans that you should get familiar with:

- Turbo: According to Bucker, this is the most popular plan as you get all benefits from the free plan, except there is an additional feature to boost your saving advance of +$600 and no fee per contribution to the fund.

- Hyper: With this premium subscription, you get even better to boost your saving advance of +1800 and get priority support from the customer service team.

Keep in mind that with the 529 plans, members will get free of charge for the first month, and then the firm will start to charge a normal fee of $5 for managing your 529 plans.

5. Is the Backer app legit?

The answer is Yes, the platform specializes in providing the 529 plan, which helps members to use the fund for their child’s future education and avoid student debts.

In particular, the Backer app helps thousands of families to avoid their kid’s student debts, which are around $500 million to pay for student college fees.

You can download the Backer app here.

7. Backer Pros and Cons

The followings are the pros and cons of Backer that you should get familiar with in order to determine whether this saving-for-education platform is the right one for you.

Pros

- Easy to step up the 529 plan within minutes.

- Provides cashback rewards for your kid’s future education.

- Can invite family members and friends to contribute to the child fund.

- Can use the firm’s website and the Backer app to manage the fund.

Cons

- You may be subject to get a fee for withdrawing from the 529 plan for non-qualified education expenses.

- There is a fee for using the investment option for the 529 plan.

Final Thoughts

The 529 plan would be an ideal solution for saving for education due to the fact that it provides a tax-free account and it’s not too complicated to open an account with Backer as you only require around 5 minutes.

In addition, you can invite your friends and family members to contribute to the kid education fund by sending money as a gift during special occasions like birthdays and holidays.

Last but certainly not least is the Backer Buck program, which allows members to earn cashback rewards for shopping online via the platform partner program.

Read next:

Don’t forget to share and Join us at Jns-millennial.com for more money tips.

By Jiro Nguyen.

The content is only based on the author’s personal opinion and research experience. It is for informational purposes only and does not rely on as a comprehensive or substitute for professional advice.

FAQ SECTION

What is a 529 plan?

The 529 plan is supported by states that enable parents to start saving for their kids' future education.

Is the Backer app safe?

The answer is yes, the platform uses a high level of website encryption and identity services that can protect your personal financial information.

Is Backer worth it?

Backer would be an ideal solution for a 529 college saving plan. Thus, you may consider saving for your child's future education