Guides To Understand and Compare Wise Currency Exchange Rates: 2023

Disclosure: This post may include affiliate links and images that we may receive compensation for if you click on the link and purchase, at no cost to you.

Updated 16/12/2022

When it comes to sending and receiving money online for your freelance business, Wise formerly Transferwise is one of the best online payment platforms besides PayPal and Payoneer, which is widely used and trusted by millions of users.

Based on my experience, I have used Wise for more than 3 three years, and all I can say is this online payment platform has helped me a lot in terms of saving money from sending and receiving money from my business partners.

In addition, this platform not only helps freelancers with their online businesses but is also an ideal solution for ex-pats to send money back home, to their loved ones.

In this post today, we will dive deeper into how to check the exchange rates in order that you can make a comparison with other online payment firms and make an informed decision for your benefit.

Key Points

Table of Contents

- Wise not only help freelancers with their online businesses but is also an ideal solution for ex-pats to send money back home, to their loved ones.

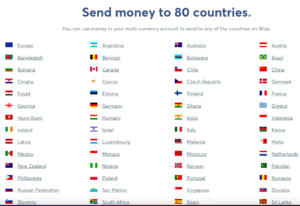

- Expats and freelancers are eligible to send money online across borders, to 80 countries worldwide.

- A step-by-step guide to checking Wise currency exchange rates.

Additional reading resources:

> Transferwise Reviews: The Complete Review of PayPal Alternative

> PayPal vs.Transferwise: Which Platform is Better?

> The 12 Best PayPal Alternatives

Is Transferwise legit?

Recently, Wise had successfully listed on the London Stock Exchange-IPO, which the company valued at 11 billion dollars on the stock exchange, at the time of writing. It indicates the company has a great reputation and brand image in the fintech sector.

In addition, the Wisetransfer platform has more than 10 million users worldwide, which makes it become one of the most popular and trusted online payment platforms in the world.

The answer to this question is ” Yes“, the Wise company is legit as it gained worldwide brand recognition and reputation in the market.

1. Wise is available in 80 countries

As you are aware, the Wise money transfer app allows members to send money online by using a multi-currencies account. In other words, they have the option to hold more than 50 currencies in their Wisetransfer account.

In addition, either with a Wise business or personal account, members can use a Wise debit card to send and receive quick money from up to 80 countries across 5 continents.

One of the great benefits of using this money app is that users can order the Wise debit card, which they can use to card to shop online or travel.

Notes, you should double-check to see if the Wise debit card program is available in your home country.

2. How to understand Wise currency exchange rates?

Before you send money online, either to your loved ones or business partners, it’s essential to check the currency exchange rates, which ensures you don’t get lost too much money for conversion to other currencies.

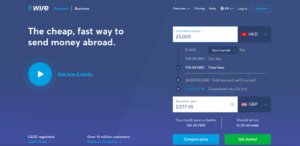

In particular, the very first action is to go to the Wise homepage or Wise money transfer app and put in the exact amount of money you want to make an online transfer.

Keep in mind that you need to select the currency in which your recipient is going to receive the money upon the money’s arrival.

For example, the screenshot above shows that I put 25,000 HKD, which converted to GBP is around 2,577.45 GBP, which means your friend or relative is going to receive 2,577.45 GBP after conversion. And, I would save up to 125.25HKD.

In addition, you also see the estimated money arrival to your friend’s account, in this case of the picture above, showing 20 mins for the money to reach the recipient account.

3. A step-by-step guide to comparing Wise currency exchange rates with others

After understanding the exchange rates of the currency, you want to send money online to your loved ones. You would be able to save money if using this money transfer app to compare the exchange rates with other banks.

It seems Wise is a very transparent company by looking at the screenshot above, which indicates the firm has nothing to hide against customers in terms of their making money transfers.

In order words, the firm does not hide any additional fees as it always provides detailed and transparent fees for customers before they want to transfer money online.

In terms of transaction security, users are enforce to use 2-factor authentication to tighten the security of their account and money transaction.

In particular, members must enter the pin code from their 2-factor authentication app like Google Authenticator in order to log in to the account and send money online.

Here is the step-by-step guide to compare exchange rates with other banks, which allows you to identify the highest exchange rate available:

- Step 1: log in to your account and navigate to the homepage.

- Step 2: put the amount of money you want to send, and remember to change the currency you want to send and receive.

- Step 3: Click “compare price“, and it will lead you to the main comparison page. You will see the exchange rate of Transferwise and others. It helps to identify which platform offers the highest exchange rates.

4. Wise Alternatives

If you are ex-pats or individuals who live far away from your friends and relatives and plan to send money online back to your home country.

You may consider trying a payment platform like Remitly, which allows you to send money online, back to your country. Remitly only allows sending money of up to $2,999 per day for those using tier 1.

In terms of freelance business, PayPal and Payoneer are other alternatives to Wise, but it is recommended to keep at least 2 or 3 payment options in order that you can use the best payment platform to suit your business needs and be able to save money on each transfer.

Final Word

There are many online payment platforms that are available in the market, which makes so difficult to make an informed decision in choosing the right money transfer app.

Keep in mind that you should always check the exchange rates and other hidden fees before you want to go ahead and make your first money transfer.

We went through the step-by-step guides to help you get familiar with how to check the exchange rates and other hidden fees. You would consider using Wise to see if it saves you money for your first money transfer.

Don’t forget to share and Join us at Jns-millennial.com for more money tips.

By Jiro Nguyen.

The content is only based on the author’s personal opinion and experience. It is for informational purposes only and does not rely on as a comprehensive or substitute for professional advice.