Payoneer Review: A Complete Review of Pros and Cons in 2023

This article has links and images regarding the suggestions that we may receive a commission if click to purchase.

Updated 01/01/2023

PayPal is the most common and popular online payment platform across the globe besides Wise, it is well known by most individuals, freelancers, and business owners due to the fact company’s reputation and global brand image.

However, there is another best Paypal alternative- Payoneer, which also has slightly similar features and functions and is well known by customers from all over the world.

Honestly, I have been using the PayPal service for more than 5 years and I completely trust the company’s service and product. Until recently, I have conducted thorough research about other services like PayPal, where I found out Paypal competitors as those companies also operate in the same industry and offer similar products and services.

In this article today, I will walk you through step by step review of one of the Payoneer, in which we will explore the key feature, functionalities, prices as well as pros and cons for your consideration.

1. About Payoneer

2. Payoneer Fees

3. How Does it Work?

4. Is it Safe?

5. How Do I Open an Account with

- Payoneer account

6. Payoneer’s Pros and Cons

Key Takeaways

Table of Contents

- The review gives you the overall pros and cons of the payment platform.

- It is best for individuals and freelancers who use marketplaces such as Amazon, Fiverr, Upwork, Freelancer, and Airbnb.

- Freelancers and business owners could consider using Payoneer as one of the payment methods to receive and send money online.

About Payoneer

Payoneer is a financial service online payment company, which is based in America. The online payment platform allows you to make or receive online transactions domestically and internationally.

Similar to Wise, Payoneer also has a huge number of customers worldwide, where most of its users are freelancers and international businesses, as well as individuals who mostly use the platform to buy and sell products online.

Keep in mind, that you need to have thorough research about what your business or individual needs, then you can make an informed decision on choosing the right online payment method.

Read next: WiseTransfer: The Complete Review of PayPal Alternative

Payoneer Fees: Payoneer account

This online payment platform assists online transactions worldwide, especially for freelancers or users in over 150 countries. The following are the 4 main aspects associated with the fees and other information (PayPal Canada to Payoneer).

- If you pay other customers by using the same Payoneer online payment platform, then most likely highly you and your friends will enjoy the free transaction. In other words, it’s completely free by using the account to make or receive payments to other Payoneer customers. (the free option is only applicable for using USD, EUR, GBP, and other selected currencies).

- The platform has a strong partnership with other online marketplaces such as Fiverr, Upwork, and Airbnb, which makes it easy for customers to make international payments. Notes, the fee will be varied if you use a credit card as the main payment.

- In terms of withdrawal fees back to your bank account, USD, EUR, and GBP- those currencies are one of your main account currencies, then it will charge users the fixed rate. ( USD-USD is $1.5, EUR-EUR is $1.85, and GBP-GBP is $2.12).

- Other than USD, GBP, and EUR, customers use different currencies on their account, then it charges a transaction rate of around %2 based on the number of transactions ( Payoneer Fees).

Related reading: How To Check Currency Exchange Rates Using Wise (TransferWise): 2023

How Does Payoneer Work?

As mentioned above, Payoneer supports online payment for its customer in over 150 countries by using either USD or local currencies. The platform gives you the tool to make and receive payments internationally, as well as you have the option to withdraw the money back to your bank account.

The process of the Payoneer sign-in is quite easy and simple as it suits both technical and non-technical savvy individuals. In particular, you only need to use your email and password to log in to your Payoneer account.

In terms of security features, users should enhance the safety protocol of their account by using two-factor authentication sign-in, which requires customers to confirm a special code that sends either to their email or phone number upon sign-in.

The main platform dashboard contains a menu that includes ” Home, Activity, Receive, Pay, Withdraw”. Personally, it is easy to use and navigate, and you don’t have to confuse about where to find the balance, invoices, tax, and transaction history.

Read next: Payoneer vs Paypal:

Is Payoneer Safe and Legit?

Since its establishment back in 2005, the company has slowly expanded its business presence and operation across the globe today it has more than 4 million active users with 14 regional offices in 4 different continents.

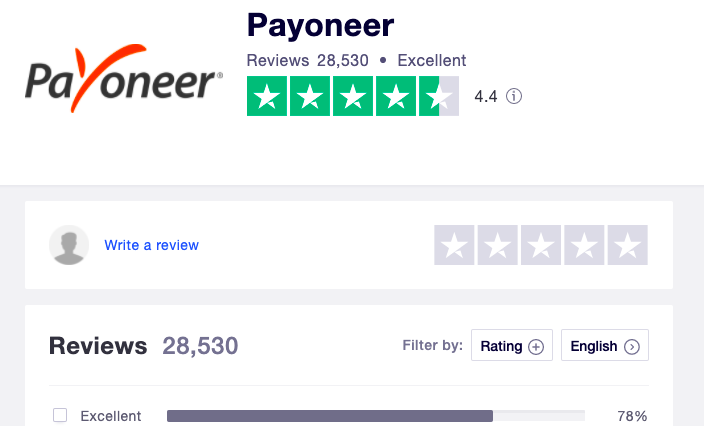

According to Trustpilot, the platform has an overall excellent customer service of 4.4 out of 5, which is based on 28,000 customer reviews worldwide. In particular, there is around 78% and 10% voted for the following 5 starts and 4 starts for delivering great customer satisfaction.

For example, the Payoneer live chat team has done a fantastic job to satisfy all the requirements of its customers. In other words, most members agree that the company has great customer service in terms of quick response, and supports customers well, especially the Payoneer live chat team.

To answer the question, ” Yes“, it is 100% safe and legit because it is fully approved by the US government as a financial service company, which can assist the transaction of their online users internationally.

In addition, the company also gets regulated by most of the countries across the globe, where its business presents itself.

How Do I Open an Account?

The process of opening an account is quite simple. The following steps of Payoneer sign-up for your consideration.

Keep in mind that it is free to open an account with the platform. And, it will be free if you make and receive a payment within Payoneer accounts.

- Go to the Payoneer homepage and fill in the application form by filling down personal detail, email address, and phone number.

- Activate your account.

- Then here you go, enter your debit card number and ID identification such as your passport and get ready to make and receive payment.

- On your Payoneer account, you have good key features such as tax administration, transaction history, use of the app, security- two-factor authentication, and customer service inquiry icon.

Members will earn $25 as a sign-up bonus when using our link.

The Pros and Cons.

After reviewing the above key features, price, and core functionalities, we have come up with a summary that covers the main Pros and Cons, and you should continue to explore it in order to decide if it is a good online payment option for your individuals needs.

Pros

- Free transactions for those senders and receivers, who use the same account to make online payments. In other words, it’s completely free by using the same account to make and receive payment ( the free transaction is only applicable for those who use USD, EUR, GBP, and other selected currencies).

- It is an ideal solution for those who don’t want to use a credit card as one of their transactions. This is because it offers an alternative option by accepting local bank transfers between the platform customers.

- The customer support team is overall good as the staff can assist with any inquiry regarding transaction issues and account balance. For example, the Payoneer live chat team is available most of the time to answer your inquiries.

- There is a free annual account service fee if you keep your account active.

Cons

- If the company suspects or figures out the transaction activities from your account that is a fraud, then the system will automatically freeze or terminate your account.

- The platform will charge higher fees of around 3% for using credit cards (Payoneer card fees) to make an online transaction.

Conclusion

Clearly, as a freelancer, business owner, and blogger, you must have at least several online payment accounts in order that you can receive money from clients or partners from all over the world.

In addition, you could take advantage of having multiple online payment options due to the fact that you can compare and select the less expensive transfer fee.

Thus, it could save a lot of money if you continue to use it over time.

Don’t forget to share and Join us at Jns-millennial.com for more tips.

By Jiro Nguyen.

The content is only based on the author’s personal opinion and experience. It is for informational purposes only and does not rely on as a comprehensive or substitute for professional advice.

FAQ SECTION

What is the best PayPal alternative?

Payoneer is a financial service online payment company. The online payment platform allows you to make or receive online transactions domestically and internationally.

Is there any Payment service similar to PayPal

Payoneer is one of the best online payment platforms, which is best for businesses, freelancers, and individuals.

What are Stripe alternatives

Payoneer PayPal Wise and Square….