Payoneer vs. PayPal: Which one is better for Freelancers?

Disclosure: This post contains affiliate links for which we may receive a commission when to click on the link and purchase. We appreciate your support.

Updated: 01/01/2023

When it comes to make money online, freelancers and small business owners have several online payment platforms to select from that allow them to receive and send money across the border without any restriction.

In particular, PayPal, Payoneer, and Wise (formerly Transferwise) are considered among the elite online payment solutions that enable online marketers to receive payment from different parts of the world for their online business activities.

It’s essential to first sort out the global payment platform, in which you can receive money from other partners or merchants, and at some points, your business needs to pay for the outgoing bills in exchange for receiving services from them.

What is the difference between the two online payment platforms that you should know in order that you can use each platform effectively?

In this article, we are going to highlight the main differences between Payoneer and PayPal in terms of services and fees, which provides you with better information for using either to accept online payments.

Key Takeaways

Table of Contents

- Both Payoneer and PayPal are two powerhouses and reputable online payment services.

- The two platforms operate differently in terms of services and features.

- Depending on a particular situation, you may either use one or both to receive payment.

> Payoneer: A Complete Review of PayPal Alternative

> The 12 Best PayPal Alternatives

1. How does Payoneer work?

Payoneer is a financial service company which is based in America. The online payment platform allows you to make or receive online transactions domestically and internationally.

The platform offers excellent customer service and great features, which create so much convenience for bloggers to send and receive money worldwide. You may not find the platform great features on other online payment platforms.

In particular, the global payment service allows small business owners to accept and send online payments by using a payment ID and a local bank account.

- Payment ID: It is one of the most popular ways for bloggers to accept payment online. They only provide merchants or clients their pay ID such as email address to receive a fund.

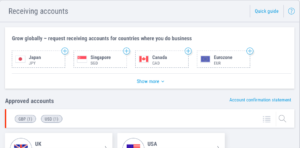

- Local bank accounts: this is one of the different features that you may not find in other online payment services.

Basically, freelancers and small business owners are eligible to create a local bank account that allows them to send and receive money using a local account. For example, they can request to open local bank accounts in other parts of the world including, The US, Japan, the UK, Canada, the Eurozone, etc.

The picture above shows that a member already had two local bank accounts, which are in the US and the UK. And, if they want to receive money in USD, so they simply just click on the US account detail ( account name, bank account number, routing, and account type) and share it with clients or merchants.

It’s one of the best ways to save money when receiving money overseas, it is because you may end up paying the extra fees for currency conversion rates if your account currency is different from the client’s.

Here is the link to create a new account using our link below:

After you create an account, we strongly recommend using second-layer security login by using your phone number to sign in. In this case, it will protect and prevent unauthorized users from accessing your account.

What you need to do is select the ” security setting“, choose “two-step verification” and then enter your phone number.

2. How does PayPal work?

PayPal Inc specializes in an online payment system. The platform is considered the largest online payment provider that allows users to send and accept payments online.

The platform works best for any type of online business and e-commerce to accept payment due to the fact that they can use their pay ID or email address to send and receive money across borders.

For example, If you are a freelance copywriter and the simplest way to receive payment is to share your email with them so that they can send you a payment.

Obviously, there are several ways that you can use your PayPal account/ PayPal app to receive payment:

- Use PayPal.me link to accept the payment: it is a short URL, an alternative way to email address.

- Create invoices on your business/ personal account.

- Use an email address as a way to accept payment.

Here is the link to create a new account using our link below:

Based on my experience, the firm has provided excellent customer service so far. In particular, my PayPal business account has an issue due to the login issue (two-factor authentication), the team enthusiastically guided me step by step to unlock the account successfully.

The firm has a strong buyers protection program, which means users can report to the platform for a refund if a product hasn’t arrived or is partly damaged.

Related reading:

3. Which one is better for small businesses and freelancing

Both platforms so far have delivered reliable service and excellent customer support whenever we need help from them. Depending on your personal/ business expectation, you may select either or both to fulfill the requirement of your business.

It’s important to understand that each platform has its functions and core competency, which reflects they have their own strengths and weaknesses. Hence, you should use each one for a specific case/ situation as it is the best way to distinguish their pros and cons.

For example, the Amazon associate program doesn’t have the option to pay affiliates via PayPal, instead, they prefer to send payment to a local bank account, check and free Amazon gift cards. For this reason, Payoneer would be an ideal solution to receive payment from Amazon by sharing a local bank account.

As mentioned earlier, PayPal works best for any type of business, affiliate marketing, and e-commerce. While Payoneer is also a great idea for small businesses, bloggers, and freelancers to receive international payment by using local bank accounts.

Conclusion

Based on my experience, I prefer to use both online payment platforms to receive payments from anywhere in the world. Especially, if there is a cheaper and better option then I will do a calculation or math to see how much money I have to pay for the transfer fee and conversion rate.

Each online payment has its core functions and features. For this reason, you may select each one for a specific case, which can bring benefits to your team and business.

Don’t forget to share with others if you find this article valuable.

By Jiro Nguyen.

The content is only based on the author’s personal opinion and experience. It is for informational purposes only, and it does not rely on as a comprehensive or a substitute for professional advice

.