Remitly Review 2023: How Does Remitly Work?

Disclosure: This post may include affiliate links and images that we may receive compensation if you click on the link and purchase, at no cost to you.

Updated: 1/01/2023

Remitly money transfer offers a cheap and easy way to send money across the globe. It is considered one of the great PayPal alternatives as it helps individuals and expats send money back to their loved ones.

You can either use the Remitly app or website to send money from the USA, Australia, The UK, and The European Union to other parts of the world.

Remitly is particularly best for individuals, immigrants, and couples who want to send money across the border to their friends and relatives.

PayPal is one of the best online payment platforms as it allows both businesses and individuals to make an online money transfer. This is because PayPal is well known for its products and services quality as well as its global reputation in the digital payment market.

However, Remitly is more specialized to help millions of immigrants, who make a huge sacrifice to work in another country. By assisting them to send money back to their friend and relatives safely, they will rest assured that the money will arrive at their destination country and can stay focused on their work.

In this session, we will take a review of Remitly in terms of its rates and fees, as well as how it works as it allows our users to get an overview of the business’s pros and cons.

Hopefully, you would be able to select the appropriate online payment platforms for making your first online money transfer.

Exclusive offer: you can sign up for Remitly here and receive $15 off when you make at least a $100 transfer.

1. Remitly Definition: What is Remitly? Best PayPal Alternative

2. Remitly Rates and Fees ( Remitly Review)

3. How Does Remitly Work?

- Remitly App

4. Is it Safe to Transfer Money with Remitly?

5. How Do I Open an Account with Remitly– Remitly Log In

- Remitly account- Remitly Log In

6. Remitly’s Pros and Cons

Key points

Table of Contents

- The Remitly app is easy to use and super responsive, which makes it so much easy for users to navigate around.

- Express transfer helps to speed up the process of transaction, within 2- 10 minutes.

- Remitly customer care team provides a quick response to any general inquiries regarding money transfer and transaction issues based on my experienced

- There is a sending limit on tier-one individual accounts, which means you can send a maximum of up to $2,999 a day and $10,000 a month.

- Generally speaking, the platform has several cash pickup options for members such as mobile money transfer, cash pick up, and home delivery.

Here are additional reading materials that are related to online payment platforms and side hustles:

> How To Check Currency Exchange Rates Using Wise (TransferWise): 2023

> WorldRemit Review 2023: How It Works and Key Features

1. What is Remitly?

Remitly is an American online payment firm, which was established back in 2011 in Settle. The company’s online payment platforms include a website and an app that helps millions of its members send money across the border.

At the time of writing, Remitly currently has served more than 3.2 million customers worldwide and has assisted them to transfer around 6 billion annually.

In 2018, Remitly expands its business operation across Europe, which is one of the stunning points to help the firm to access the $121 billion market potential. In this case, the firm is granted to access 11 countries across Europe and assists customers to make an online money transfer in a fast and convenient way.

In particular, the mobile app is easy to use and reliable, which helps to speed up the process of sending money faster and easier. In 2019, Remitly reached a milestone to expand its international operation by partnering with Visa.

The agreement meant it makes it so much easier for the sender to make a cross-border money transfer. In particular, the receiver is just to provide the Visa debit card number to the sender, where the money will arrive in their bank account.

Related reading: MoneyGram Review 2023: How to Make The First International Money Transfer?

2. Remitly Rates and Fees

In terms of Remitly rates and fees, customers are allowed to select the transfer options based on the two main method

- Economy fee: cheaper than express transfer, and it’s a more affordable and cheaper way of sending money internationally. But, you will need to wait for at least 2-3 days until the money will arrive.

- Express transfer: the fee is higher than the economy transfer, but Remitly will ensure the money will arrive within 2-10 minutes. if there is nothing with the transaction.

Service fee: users may not need to pay for the first one or two transactions because it’s completely free for new customers based on the firm policy. Also, the service is relatively cheap as it normally charges a flat rate of less than $3.99 per international transaction- this is for a sender who resides in Australia.

Important notes, the service fee, and rate will be charged based on the total amount of money sent and the country’s destination. For example, If you send money from the US to India, the service fee will be different than sending money from the US to the Philippines ( Remitly to the Philippines, Remitly to India).

And, this is a link to calculate transfer costs on the Remitly app and the website, where the Remitly virtual assistant will help you to calculate how much it cost to transfer money to your country’s destination.

Importantly, if you are not in a rush to send money overseas or have a proper plan before making any payments. Then, Remitly money transfer offers a free service fee for international transactions, but you have to wait for 1 to 3 days in order to receive money. Therefore, Saving is always the best solution for everyone.

3. How Does Remitly Work?

Remitly money transfer is one of the best online payment platforms, which helps millions of individuals and immigrants to send money back to their home country ( to their friends and relatives). The company’s core principles are based on total transparency, affordability, and fast transfer as this is based on the business statement.

It claims to give an affordable service fee to customers due to the fact that Remitly mainly serves its clients as a digital service. For this reason, customers would be able to save based on the cheaper service fees.

In fact, users can send money internationally to up to 145 countries across the globe with 75 plus currencies for recipients receiving the fund. With several options for your loved ones and relatives to receive money as follow:

- Send money directly to the recipient’s bank account using the Remitly app. Based on my experience, this is considered the best way to transfer money internationally because it only takes around 5 mins to receive the fund, if there are no issues.

- Cash pickup: receive cash from the available pick-up location.

- Mobile money: the recipients receive money from their mobile money account.

- Deliver money to the recipient’s house

Let’s move to the step-by-step process of how you can start to make your first transfer with Remitly

- The first and foremost important is to download the Remitly app, which is available on the Google play store and Apple Store.

- Remitly log in: sign up and ensure you can sign in on the Remitly app or Website.

- Before sending: ensure you fill in all the essential information of both the sender and receiver. Pay more attention to bank account detail, and always double-check if necessary.

- After finishing all the above steps, then you are ready to make a transfer ( Remitly will take care of the rest for you to ensure the money will arrive at your loved ones).

4. Is Remitly safe?

The answer is YES, it’s absolutely safe to make an online money transfer with Remitly. It’s because Remitly is authorized to operate the business across the USA, Canada, and other countries based on the license they have received in each country of operation.

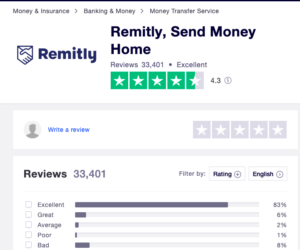

According to the Trustpilot review, Remitly has a good customer rating of 4.3/5 based on 30,440 customer reviews. It indicates that Remitly is one of the best money transfer platforms to provide fast and affordable service to all customers.

Importantly, CEO and founder Matthew Oppenheimer had emphasized the importance of sending money across borders based on an affordable service fee, and legal requirements to the US Congress. Remitly was established after the founder had an experience living in another country and understood how it is difficult to mone an international money transaction.

In particular, the mobile app is easy to use and reliable, which helps to speed up the process of sending money faster and easier. In 2019, Remitly reached a milestone to expand its international operation by partnering with Visa.

The agreement meant it makes it so much easier for the sender to make a cross-border money transfer. In particular, the receiver is just to provide the Visa debit card number to the sender, where the money will arrive in their bank account.

5. How Do I Open an Account with Remitly?

As mentioned in section 3 ” How does Remitly work” you would be able to understand the process of creating an account with Remitly. Here is a guide to help you create an account.

- First and foremost important is to download the Remitly app, which is available on Google Play Store and Apple store

- Remitly Sign up: Simply fill down all the detail of both sender and receiver, which includes email, name, passport, and bank detail.

- Remitly log in: double-check to ensure the bank account number of the recipient is correct.

- After completing all the above steps, then you are ready to make your first online money transaction. Notes, Remitly has the service to send money to India, and the Philippines ( Remitly to the Philippines, Remitly to India).

6. Remitly’s Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

Don’t forget to share and Join us at Jns-millennial.com for more money tips.

By Jiro Nguyen.

The content is only based on the author’s personal opinion and experience. It is for informational purposes only and does not rely on as a comprehensive or substitute for professional advice.

FAQ SECTION

What is Remitly?

Remitly is an American online payment firm, which was established back in 2011 in Settle. The company's online payment platforms include a website and an app that helps millions of its members send money across the border. ( best PayPal alternative)

Can I trust Remitly?

The answer is YES, it's absolutely safe to make an online money transfer with Remitly. It's because Remitly is authorized to operate the business across the USA, Canada, and other countries based on the license they have received in each country of operation.

How long does it take to receive money from Remitly?

Economy fee: cheaper than express transfer, and it's a more affordable and cheaper way of sending money internationally. But, you will need to wait for at least 2-3 days until the money will arrive. Express transfer: the fee is higher than the economy transfer, but Remitly will ensure the money will arrive within 2-10 minutes. if there is nothing with the transaction.

Is Remitly App any good?

Overall, Remitly app has done a great job in terms of connection and quick respond, as it is based on my personal experience.

How Do I Open an Account with Remitly?

First you need to sign up and download the Remitly app. Follow up by filling down other important information such as personal detail, and bank account.