SWOT Analysis: Strengths and Weaknesses, And External Factors

Table of Contents

Updated: 03/08/2023

What Is A SWOT Analysis?

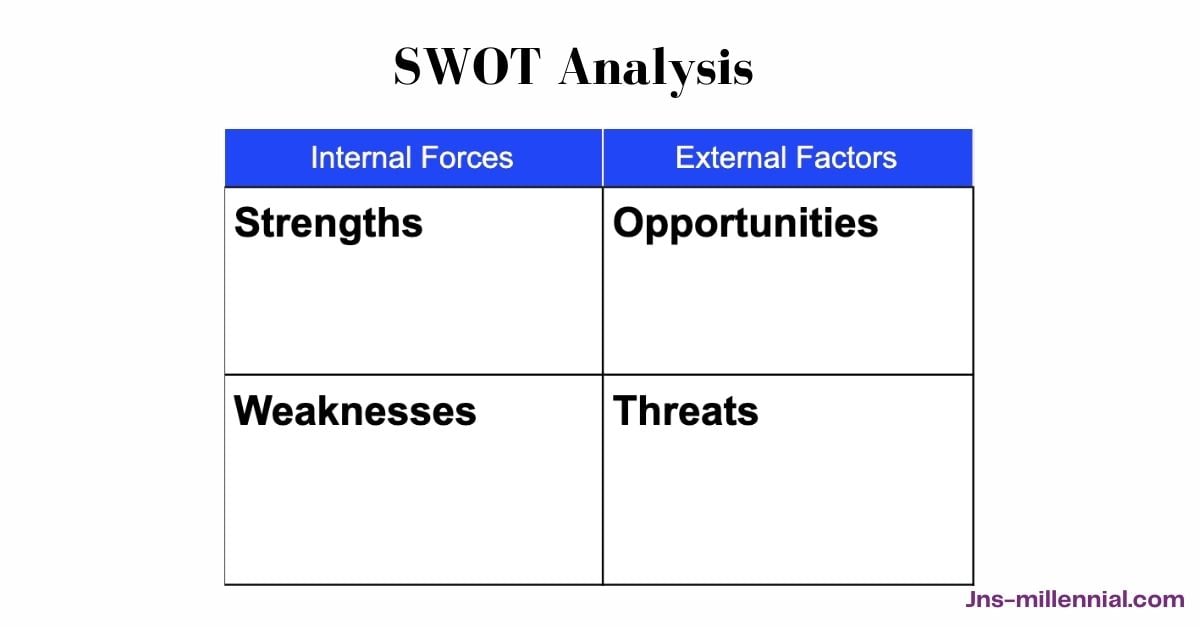

A SWOT analysis is a tool that analyzes how effective internal and external factors are for businesses and mostly it is being done for making decisions. In particular, the fundamental analysis of each element: strengths, weaknesses, opportunities, and threats represented both internal and external factors as well as future potential for the business.

By carefully analyzing internal factors, the organization or company would be able to identify its strengths and weaknesses based on its current situation. Those could be a lack of supply chain, high level of employee turnover rates, and product and service quality, just to name. Importantly, internal forces would be easily managed or controlled by the board of directors of the firm, if they effectively implement the right strategy and solid to address those internal issues within an organization.

On the other hand, threats and opportunities are considered external factors, and those forces might not be controlled by the organization like strengths and weaknesses. For example, threats from intense competition in the market, which is considered an external factor, which is hard to manage by the firm. It is important to analyze threats and opportunities in SWOT analysis that allow the firm to create a suitable strategy to minimize the impact of those external forces.

A SWOT analysis is an essential tool to make the analysis on personal, and organizational levels, which helps us to determine the strengths, weaknesses, and external factors. Based on the internal and external analysis, we should be able to design a better strategy to compete with others in the market or any related field.

Let’s move into the detail of each element from the SWOT analysis, which helps you get familiar with this analysis tool.

Related reading: Porter’s Five Forces: How Forces Model Shapes Business Strategy

What Is A SWOT Analysis?

SWOT Analysis’s internal and external factors? Strengths and Weaknesses, Opportunities and Threats

A SWOT Analysis Example- Treasury Wine Estate Ltd (SWOT)

SWOT Analysis’s internal and external factors? Strengths and Weaknesses, Opportunities and Threats

-

Strengths

Strengths are the first internal factors that allow the organization to highlight its core competency as it is vital to differentiate the business from other rivals within the same industry. For this reason, strengths can boost to increase the higher level of competitiveness of the business, in other words, it is considered a competitive advantage in the market.

For example, Tesla’s strengths could be counted as follow: innovative technology, strong leadership, marketing strategy, and the company’s solid supply chain. From those strengths, Tesla continues to be a leading automotive electric car marker across the globe.

According to CNBC, Elon Musk is considered the best strength and weakness of the electric automaker firm. From the strength perspective, with Elon Musk’s genius leadership and vision, Tesla has become the main driving force as a leader in leading the electric vehicle market.

In addition, Strengths are also considered as the value proposition of the business, if the firm knows how to utilize its strongest resources to compete with other main rivals in a market.

Related reading: Marketing Strategy: How to Write 7 Ps of Marketing For Starting a Business

-

Weaknesses

It is essential to understand the weaknesses we are having because this is the only way to identify and overcome the roadblocks based on this fundamental analysis. Like many other tools and the porter’5 forces model, A SWOT analysis is only useful and improves the business strategy, if we know how to honestly highlight each element in a correct way, without any bias.

Weaknesses are part of internal features alongside strengths, which the organization has the ability to influence. Those features could be tangible and intangible assets of the company. For example, a high level of employee turnover rates emphasizes the weakness in the human resource department.

For this reason, the firm can only improve its products and services over time, if it has the ability to identify and improve those weaknesses. As a result, the improvement may either help to minimize the loss or increase the business’s earning capability.

-

Opportunities

Opportunities are considered external forces, which the board of management may make a change within the organization in order that they can cope with the new external threats or open to new opportunities such as technology development, IT development, new software development, research, and development.

By opting to change, the firm might have a great opportunity to meet the current market demand and be able to compete with other competitors.

For example, the world’s strongest nations including America, China, European Union, Australia, and Canada have all agreed to reduce carbon emissions usage to zero percent by 2050. This could provide an opportunity to exponentially develop electric vehicle technology within the automotive industry. For this reason. Toyota, Honda, and other big players have continued to pour millions of dollars into research and development, which allows them to compete with Tesla in the electric vehicle sector.

-

Threats

The last element of SWOT analysis is threats, this is external forces that have a negative impact on the business’s survival in the long run. Those threats could be issues with the supply chain, global economic crisis, or natural disasters, which pose a real threat to your firm’s sustainable development.

This is because those external factors are almost out of control, and the only thing we could do is to early determine the warning based on the threat levels to help the firm design a remedy strategy to minimize the impact.

Furthermore, new regulations and government policies, consumer behavior patterns are also part of external threats, and you should pay close attention to make amendments to the current strategy to cope with the market demand.

Reading next: JL Collins: The Simple Path to Wealth Book Review

A SWOT Analysis Example- Treasury Wine Estate Ltd (SWOT)

-

Treasury Wine Estate Ltd (SWOT):

Strengths

- Strong brand recognition

- World’s largest winemaker and distributor

- The super-wide product range

Weaknesses

- The long-distance between markets and production (Australian wine in Finland)

- Low marketing is only selling to countries

Threats

- Global economic fluctuations can affect demand

- Local cheap winemakers.

- Ongoing Tit for Tat trade war between America and China.

- And Australia is also involved in diplomatic tension with China at the time of writing.

- Since the start of the Covid-19 pandemic, the global supply chain has been disrupted so badly due to the ongoing lockdown across the globe, at the time of writing.

Opportunities

- Wine is becoming more common with a healthy eating trend in the world

- The drinking trend is heading toward lighter drinks such as wine.

Weaknesses

TWE’s products are being sold in more than 70 countries around the world and this provides a high level of recognition as the company has a range of products in the global market.

Producing and distributing around the world is hard to process and it can lead to creating some problems, for example, an Australian high-quality wine could be provided in a small town’s bottle shop somewhere in Finland, also the company has more than 70 brands and it requires a very strong delivery system, it could be very expensive. Additionally, Australian wine is being sold.

Opportunities

These days a number of research are supporting regular wine for human health. According to BBC Good Food (2016) mostly men and women over 40, regular daily wine drinking is reducing the risk of heart disease. Drinking trends are more with lower-level alcohol.

Threats

People’s economy is more sensitive than before past these days and with low incomes, people possibly consider their alcohol consumption, for example reducing high-quality wine consumption. Also working globally has a factor of local competitors, their products could be cheaper and more quality because the cost of production and distribution will be cheaper.

References

- Guru Focus. 2016. Australian Vintage Ltd (OTCPK: AUVGF) Long-Term Debt. Accessed May 2nd. htttp://www.gurufocus.com/term/Long-Term+Debt/AUVGF/Long-Term-Debt/Australian-Vintage-Ltd

- Investing Answers. 2016. Why it matters: Debt-to-Equity. Accessed May 1st. http://www.investinganswers.com/financial-dictionary/debt-bankruptcy/leverage-ratio-5287Treasury wine estates limited – company capsule. (2015). (). Basingstoke: Progressive Digital Media.

- CNBC, ” Musk is Tesla’s greatest strength and weakness”.https://www.CNBC.com/2016/07/13/musk-is-teslas-greatest-strength-and-weakness-says-valuation-expert.Html.

- Investopedia. Strength, Weakness, Opportunity, and Threat (SWOT) Analysis.https://www.investopedia.com/terms/s/swot.asp.