Transferwise Reviews: The Complete Review of PayPal Alternative 2023

This post may include affiliate links and images that we may receive compensation for if you click on the link and purchase, at no cost to you.

Updated your 16/12/2022

Have you ever thought of selecting another international money transfer besides PayPal and Payoneer, which can use for both businesses and individuals?

Then you are in the right spot to think of this Global online payment company, which is TransferWise.

I have been an active user of Wise Money Transfer ( formerly known as TransferWise) for nearly a year. And, All I can say is this digital payment platform has done a good job overall in terms of providing satisfactory service, and support, as well as offering a higher exchange rate compared with other international payment platforms.

Why?

TransferWise offers an alternative way to send money internationally at the cheapest rate besides PayPal. It is especially suitable for both individuals and businesses that make frequent and high-volume transfers, where you might save a lot of money for transferring regularly.

For a quick review, I list five main aspects to help you get familiar with Transferwise in terms of customer service and transfer fees. You should further read the following sections to understand how Transferwise works.

Key Takeaways

Table of Contents

- Global Reputation has over 10 million users

- Offer a better exchange rate.

- British Fintech Firm- plans to initial public offering IPO on the London Stock Exchange.

More reading materials:

> Payoneer vs. PayPal: Which platform is better for Freelancers?

> PayPal vs.Transferwise: Which Platform is Better?

> 3 Best Ways to Accept Payment via PayPal

1. About TransferWise

TransferWise is one of the largest international money payment solutions besides PayPal. The company was established back in 2011- almost 11 years. This is a United Kingdom-based financial technology payment company, where the head office is located in London.

The surprising fact is Sir Richard Branson- founder of Virgin Group, which controls more than 400 small companies. He had committed to supporting Transferwise as one of the best fintech firms by investing around $24 million into the firm development.

In the beginning, the company slowly expanded its operation across the UK, and then in 2014, it first established an overseas office in one of the countries in the European Union.

For this reason, TransferWise has successfully established its physical offices across the globe, where there are around 14 regional offices located on five continents, which aim to support international money transactions for its customers.

Recently, Transferwise announced that it would allow Indian Users based in India, would be able to send money abroad to 44 countries, which include The U.K., countries in the Euro Zone, The USA, and Singapore, just to name a few.

For this reason, it was good news for Indian families who have their relatives, friends, or family members studying abroad because they might be allowed to send money abroad by using TrasnferWise digital payment ( CNBC, 2021).

Importantly, British fintech firm Transferwise-Wise is going to initial public offering IPO on the London stock exchange as the event indicates the significant success of Wise expansion strategy over the past 10 years.

According to the company CEO-Kristo Kaarmann, the success is due to Wise following its key values and principles based on service efficiency, price affordability, and total transparency. ( Source CNBC, Wise Plans to go public in London, 2021)

Transferwise is widely trusted all over the world, in which the platform supports both individual and business transactions, and values over $6 billion every month. In other words, it saves people and businesses around $3 million in fees every day.

Importantly, Transferwise has fully cooperated with each country in its business operations, and they got granted as FCA regulated, which is trusted by the local authorities and consumers- “based on the statement of TransferWise.”

2. TransferWise Fees? (Transferwise)

As mentioned before, the online payment platform assists nearly $6 billion in international transactions every month because there are more than 14 physical offices over the world to support those transaction activities.

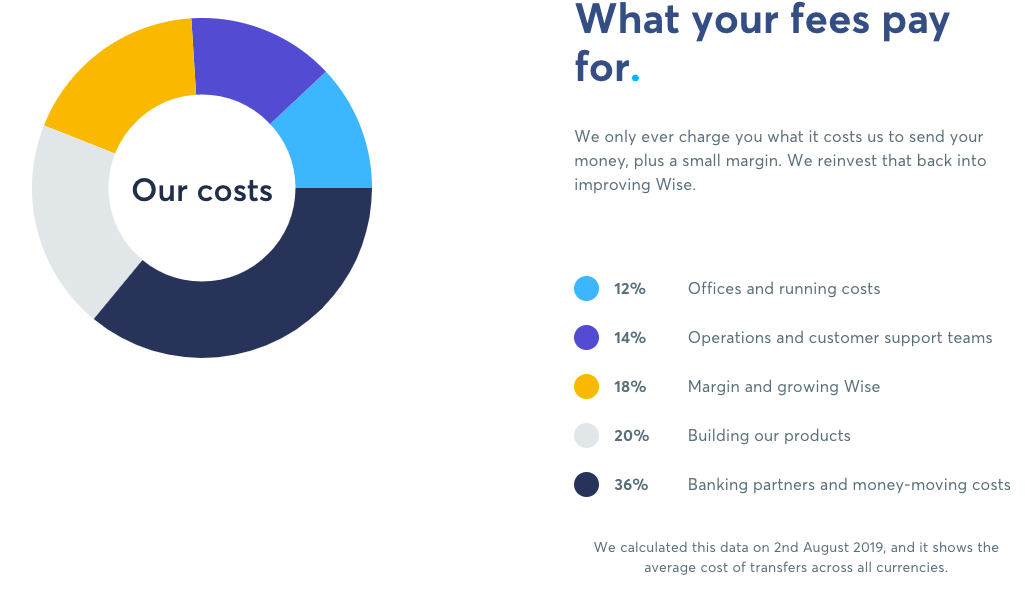

In terms of Transferwise fees, it is completely free to open an account as well as free to keep an account active with more than 50 currencies with Wise. The transfer fee will be started from 0.35%, which depends on the currency you use to send.

The online payment solution states to give the users the best exchange rate possible without any hidden fees. Based on my experience, I have saved nearly $90 in one transaction value of $2,000 with TransferWise, compared to other payment platforms due to the exchange rate and the service fee.

Overall, Transferwise fees and exchange rates are considered one of the cheapest rates compared with other global payment platforms. Thus, it helps to save customers nearly $1.5 billion in money transfers every year.

Read next: The 12 Best PayPal Alternatives in 2023

3. How Does TransferWise Work?

TransferWise is an ideal solution for making international money transactions, where it helps customers to send money across the globe without any descriptions- claims by the firm statement.

Transferwise login

There is a step-by-step guide to help users get familiar with How to use TransferWise to make their first international transfer?

- The first and most important thing is to check the “EXCHANGE RATE” and calculate how much it costs to make an international transfer. Users either calculate the “fee and exchange rate” on its homepage or use their calculation.

- TransferWise Login: If you are happy with the ” Exchange Rate”, then you can go ahead to open an account with TransferWise. It’s super easy, first, you need to set up the account ( not even 2 minutes)- fill down your name, email address, debit card number, and passport. Here you go, your account is ready to set up in 2 minutes.

- The third step is to choose the location, to which you wish to send the money, along with the receiver’s bank details. Importantly, depending on each country’s requirements, you have the option to send money to a relative, or a friend.

- Double-check that all the information is correct, and use either debit or credit cards to make the payment for the transaction.

- After you are satisfied with all the above steps, then TransferWise will take care of the transaction by using its own technology to estimate when the money will arrive.

For example: let’s say you want to transfer money to Singapore with SGD, first you need to deposit money and choose the currency of your preference. your final step is just filling down the recipient and receiver information- once you click the transfer then the receivers will get the money in just 1 minute.

According to CNBC, the British fintech firm Wise adds to create more convenience for its customers by adding investment features to the Wise app. In other words, the company allows its users to invest in stocks by using the Wise app and let them make online money transaction based on their account balance.

4. Is Transferwise Safe?

According to the ” Trustpilot”, the most reputable review company in the world, it conducted a review of more than 114,379 customers ( Transferwise customer service), where the result claimed that Wise’s s product and service overall achieved a high level of consumer satisfaction. In other words, the overall customer rating is excellent for the following reason

- The platform claims to provide the most transparency and no hidden fees to its users. And, it helps to save around $ 3 million dollars every month for international transactions due to this corporate social responsibility practice.

- Importantly, there are over 10 million active users, who make international transactions valued at nearly $6 billion every month. This reflects Wise Transfer is trusted by consumers from all over the world.

- The third aspect is the FCA is regulated, almost both local and international authorities have granted permission for the firm to assist customers with financial transactions. For instance, America, the United Kingdom, European Union, Australia, Canada, and India, just to name a few all allowed companies to operate their business across those countries by sending money internationally.

To answer the question, yes it’s definitely safe to use and deposit money with Wise Transfer because it is a reputable company, where it is trusted by millions of consumers all over the world.

Read next: 8+ Proven Ways to Find Freelance Writing Jobs Online For Beginners

5. How to Open an Account With TransferWise?

In order to make your first international transaction, then you would need to follow the step-by-step guidelines, which you can follow and use as a preference for your first sending money.

- First and foremost, you need to create an account. All you need to do is an email address, Google, or Facebook account. Importantly, it’s free to set up online or in the app.

- TransferWise login: choose an amount you would like to send, then the platform will show the cost per transaction and notify you when the money will arrive.

- The third step is to fill in the detail of a receiver- normally bank account and the name are good enough.

- Verify your identity: by using your passport or ID to verify your account because it is a requirement by law and regulation in some countries or send a large amount of money. Importantly, it keeps your money safe.

- Pay for the transfer: you can pay via debit or credit card or make a transaction from the bank account.

- Done, the platform will notify both you and the recipient when the money will arrive.

In addition, customers have the option to choose up to 45 currencies to manage their accounts. For example, you can either choose the local currency or USD to transfer or receive money from your TransferWise account. Especially for the business, your customers are eligible to pay by using their own currency.

6. Pros and Cons of TransferWise

Pros

1. The exchange rate is considered one of the best compared with other international money transfer platforms.

2. Transferwise fees:

- Service Fee: $3.50– for a normal international transaction

3. It claims to offer multiple currencies for customers to choose from.

4.24/7 online support

5. Fully regulated by both international and local authorities.

5. Transparency and no hidden fees.

Cons

1. It May take longer than usual until the money arrives.

Overall, TransferWise offers a great way to send money internationally at a cheaper rate compared to other digital payment wallets. And, is especially good for individuals and businesses that make frequent and high-volume transfers as you might save a decent amount of money for making multiple transactions with Wise.

Wise is well known for its reliable service, and transparency, and offers a better exchange rate for online money transfers.

It is considered an alternative to PayPal because Wise has a totally transparent policy. In particular, users will see all the involved costs that appear on the receipt.

Related reading: Remitly Review 2023: How Does Remitly Work?

By Jiro Nguyen,

The content is based on the personal opinion of the author. It is accurate and true based on the best knowledge of the author and his research. It should not use as a comprehensive or a substitute for professional advice.

FAQ SECTION

What is the best PayPal alternative?

Transferwise is widely trusted all over the world, in which the platform supports both individuals and business transactions, values over $6 billion every month. In other words, it saves people and businesses around $3 million in fees every day.

How Does TransferWise Work?

You first need to sign in the Wise’s platform, and make an online transaction. Ensure you input the correct name and bank account number.

Is Transferwise-Wise Safe?

According to the Trustpilot, the most reputable review company in the world, it conducted a review of more than 114,379 customers ( Transferwise customer service), where the result claimed that Wise's s product and service is overall achieved a high level of consumer satisfaction. In other words, the overall customer rating is excellent for the following reason.

How to Open an Account With TransferWise?

you would need to follow the step-by-step guidelines, which you can follow and use as a preference for your first sending money. 1. Create an account 2. Login to TransferWise app. 3. Fill in detail…..

Is TransferWise a good company?

Transferwise is widely trusted all over the world, in which the platform supports both individuals and business transactions, values over $6 billion every month. In other words, it saves people and businesses around $3 million in fees every day. Importantly, Wise Transfer has fully cooperated with each country in its business operations, and they got granted as FCA regulated, which is trusted by the local authorities and consumers- based on the statement of TransferWise.