PayPal vs.Transferwise: Which Platform is Better?

Disclosure: This post contains affiliate links for which we may receive a commission when to click on the link and purchase. We appreciate your support.

Updated: 22/12/2022

Traditionally, people always prefer to go to the bank for sending an online transfer when it comes to making an international money transfer to their loved ones.

However, with the development of advanced technology, there are some fintech companies that are capable of supporting banking and financial services including international money transfers.

In particular, PayPal and Transferwise are among the elite companies in the fintech sector that help to assist online money transfer worldwide. Those two top fintech firms have a cross range of features and services to satisfy the expectation of customers in terms of exchange rates, advanced apps, and fees.

In this comparison, I will take a deep analysis of those two favorite firms, which covers fees, exchange rates as well as customer services. You may use this information to make a better decision for selecting the better one based on your needs.

Key points

Table of Contents

- Wise and PayPal are the two best fintech firms that have a strong brand image and reputation in the market.

- PayPal has more than 400 million users worldwide, while Wise has much less than that number around 10 million users.

- Depending on the need of each individual, you may select the one that is following your expectations.

What is PayPal?

PayPal inc is an American firm based in Califonia, which specializes in an online payment system in terms of sending and receiving money. The firm also acts in the online payment system that helps individuals, freelancers, and businesses securely purchase things online.

Interestingly, the firm was established in 1998 by a group of entrepreneurs, and Elon Musk, a billionaire, and the CEO of Tesla and SpaceX is one of the co-founders who got a hand to build PayPal inc at the very beginning.

Since its establishment, PayPal has had exponential growth over the last 20 years and has become the largest fintech firm in terms of revenue, number of customers, and market operation worldwide. In particular, PayPal has more than 425 million active customers in over 200 countries and supported more than 5 billion payment transactions in quarter 4 of 2021.

Based on my experience, PayPal has a great customer service team that patiently helps me to solve most of the common issues within my account. Specifically, My PayPal business account got locked last time due to the login issue with the two-factor authentication code. The team enthusiastically guided me step by step to unlock the account successfully.

Related reading: The 12 Best PayPal Alternatives in 2022

How does PayPal work?

As mentioned earlier, PayPal is a financial service that facilitates online money payment securely. The process of making an online purchase is very straightforward as you only need to use your bank card, or bank account to connect with your existing PayPal account, which allows you to make and receive online transactions.

The platform has more than 400 million active users worldwide including individuals, freelancers, and businesses, and facilitated more than $340 billion in online transactions in quarter 4 of 2021.

Besides paying money using a PayPal account, users also have the option to receive money through services. As a result, they can either withdraw money to their bank account or use the balance to pay for something.

PayPal also facilitates online money transaction across the border that allows users to send and receive money from or to their friends or family members through a PayPal account. In case there is a currency conversion, then PayPal will apply a small fee to facilitate the online transaction.

The following are step-by-step procedures to help you open a PayPal account, either a personal or business account:

- The first and foremost important is to create a PayPal account by clicking on the PayPal sign-up.

- Users have the option to select ” personal account” or business account” upon creating a PayPal account. Fill down personal information and home address.

- Log in to your PayPal account (Paypal log in) and connect your bank account and bank card to your PayPal account.

- Congratulation! now you can use a PayPal account for transferring money online or receive payment for the service.

For the business account, It’s an ideal solution to open a business account with PayPal because it provides many great features and services. For example, business owners can create free invoices to send or receive money from their partners, which those invoices can use for tax deduction purposes.

PayPal fees and Exchange rates

One of the greatest benefits of using PayPal is that it has a strong buyers protection program, which allows buyers to get a refund if the products they bought still haven’t arrived or are described falsely in the product description. Hence, this buyer protection program is especially best for buyers, freelancers, and individuals who actively search for buying items on eBay and Amazon.

In terms of fees, PayPal will charge a service fee if you want to transfer money back to your assigned bank account or bank card. And, if you run an e-commerce store like eBay or Amazon, then it can be a small fee applied if you want to receive money to your PayPal account.

It’s free if you make an online transfer to your friend through PayPal ( must use the same PayPal account to send money, and there is no currency conversion). The platform will apply 5% for an online transaction when users wish to send money internationally.

As mentioned earlier, if there is a currency conversion, then PayPal will apply a small fee to facilitate the online transaction. The fee can be applied if you want to make an international transfer to the receivers’ bank accounts.

For the exchange rates, the rate can be fluctuated, depending on the currency market movement. Here is the link you can check the currency conversion rate through the platform’s official website.

⇒ PayPal Currency Converter Tool

PayPal’s Pros and Cons

Here is the list of advantages and disadvantages of using the platform.

Pros

- Strong reputation and widely accepted worldwide

- The largest fintech with more than 400 million active users

- Excellent customer support to answer most common issues

- There is a free account sign-up, either for business or personal accounts.

- No fee when you send money domestically, as long as there is no currency conversion.

Cons

- There is a fee applied when you send money to your assigned bank account and send money internationally.

- If you send money using a credit card, or debit card payment, then the platform can be charged a small fee.

Related reading: Transferwise Reviews: The Complete Review of PayPal Alternative 2023

What is TransferWise?

TransferWise is one of the best fintech firms that facilitates online money transactions across borders. The platform has a cross range of useful features and services, which make it much easier for users to send money to their loved ones, family members, and friends.

Wise was established in 2011 by co-founders, Kristo Käärmann and Taavet Hinrikus, in London, the United Kingdom. It’s a financial technology payment firm that allows users to send and receive money through the service.

At the time of writing, the company has more than 12 million active users and has established 14 physical offices all over the world. The main purpose of those regional offices is to support international money transactions for its customers.

Interestingly, Sir Richard Branson- founder of Virgin Group has more than 400 small companies. He had announced to invest of more than $24 million into the development of Wise’s platform.

According to the company CEO-Kristo Käärmann, the success of Wise is due to the firm following its core value and principles, which are ” Service efficiency, price affordability, and total transparency. ( Source CNBC, Wise Plans to go public in London, 2021).

How does Transferwise work?

Wise has much lesser active members than PayPal, but Wise also has a strong reputation and credibility in the online payment section due to the fact that it provides a few additional benefits to satisfy customer requirements.

In particular, Wise is well known for its service speed as it facilitates fast online transactions, normally within minutes. But, in some rare cases, customers will have to wait for a few days until the money arrived.

The platform supports both individual and business transactions, valuing over $6 billion every month. In other words, it saves people and businesses around $3 million in fees every day.

Besides online money transfers, Wise also offers a secure and safe way to purchase items on the internet. As you simply add your bank account, and credit cards, users have the option to hold 50+ currencies when they are shopping at overseas online stores.

The following consists of step by step guide to help you get your account set up with Wise:

- Open an account with Wise by clicking on the link below. Simply fill down your personal detail and email address.

- Log in to your Wise account ( TransferWise login) and simply add your bank account, credit, or debit card.

- Verify your identity: by using your passport or ID to verify your account because it is a requirement by law and regulation in some countries or send a large amount of money.

- Congratulations! now you can make an online transfer with Wise or pay for items online.

Here is the link to help you get started with Wise and be able to send money abroad in a cheap and fast way as possible.

TransferWise Fees & Exchange rates

In comparison with other financial institutions, Wise is considered the best platform to charge the lowest service fee without any extra fees. In particular, the firm always shows the transfer fee and exchange rate to customers before they make an informed decision about the online transaction.

It is completely free to open an account as well as free to keep an account active with more than 50 currencies with Wise. The transfer fee will be started from 0.35%, which depends on the currency you use to send.

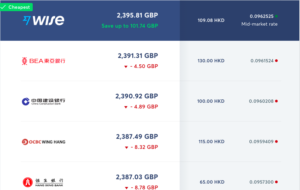

By checking the above picture, you can see other related fees that may apply to your situation. There is a small fee for a currency conversion, which starts from 0.35% as it depends on the specific currency you want to convert to.

Wise’s Pros and Cons

Here are the advantages and disadvantages of using Wise, which give you the right information to make a decision on choosing the right online payment platform.

Pros

- Wise offers cheaper and better following service fees and exchange rates.

- Customers are eligible to hold 50+ currencies on their account, which they may use to pay for overseas online stores.

- Fully regulated by both international and local authorities.

- Transparency and no hidden fees.

Cons

- The transfer fee will be started from 0.35%

- There is also a small fee applied when you use a credit card to make online transfers

What platform is better for you?

Wise and PayPal are the two best online payment services that offer a cross range of useful features and services, which you may not find on other payment platforms.

As a small business, it is always an ideal solution to open an account with PayPal because it allows business owners to receive and send money through their platform. In addition, it has a feature to create invoices for selling products online.

Wise offers a great way to send money internationally at a cheaper rate compared to other digital payment wallets. Wise is well known for its reliable service, transparency, and offers a better exchange rate for online money transfers.

Depending on the need of each individual, you may select the one that is following your expectations.

Both platforms are best for freelancers as they can use the platform to receive money for their services.

Don’t forget to share the article with others if you find it helpful.

By Jiro Nguyen,

The content is based on the personal opinion of the author. It is accurate and true based on the best knowledge of the author and his research. It should not use as a comprehensive or a substitute for professional advice.

FAQ SECTION

What is PayPal best for?

It is always an ideal solution to open a business account with PayPal because it allows business owners to receive and send money through their platform.

What is Wise best for?

Wise offers cheaper and better following service fees and exchange rates when it comes to transferring money online

What is the best platform for freelancers

Wise and PayPal are the two best online payment services, which allow freelancers to receive money for their services.