Square Review: A Complete Review of Pricing, Features, Pros, and Cons of PayPal Alternative

Disclosure: This post may include affiliate links and images that we may receive compensation for if you click on the link and purchase, at no cost to you.

Updated 29/12/2022

When mentioning the digital online payment system, people first think about Paypal as an ideal solution to support their everyday business transactions. This is because PayPal is well known for its quality products and services as well as its global reputation in the digital payment market.

Square online payment platform is one of the best PayPal alternatives, which offers similar service ranges and features for both large and small businesses. Moreover, the American financial services and online payment company also is considered an ideal solution for individuals and especially POS for restaurant owners because the platform offers a secure and convenient network to support digital money transactions.

In addition, Square also accepts the use of credit cards such as Citibank credit cards to make a transaction locally and internationally, which the company aims to create the best customer satisfaction possible.

In this article today, the following key points will be discussed in more detail in order to provide you with a better knowledge of Square products and services- and consider whether Square is a good fit for your business or individual needs.

1. About Square Company: PayPal Alternative

2. Square Fees

3. How Does Square Work?

- Square Sign in

4. Is Paying with Square Safe?

5. How Do I Open an Account with Square– Square Sign up

- Square account-Square Login

6. Square’s Pros and Cons

Key Takeaways

Table of Contents

- Square is the ideal solution for small businesses to make and receive money through online transactions.

- the platform and POS system are Square’s forefront technology, and Square become one of the most powerhouses in the online payment market alongside PayPal: Square vs PayPal.

Here are additional resources that are relevant to online payment services:

> How To Check Currency Exchange Rates Using Wise (TransferWise)

> Payoneer: A Complete Review of PayPal Alternative

1. About Square Company: PayPal Alternative

Square, Inc is founded back in 2010 in The United State of America- the company was a registered business as a financial service and digital payment company, which mainly uses its online payment platform to assist money transactions both locally and internationally.

Over a short period of time, Square, Inc has been rapidly expanding its business globally in terms of market presence and market capitalization as well as the huge number of active customers from all over the world. In particular, the company was first IPO initial public offering on New York Stock Exchange back in 2015, and now Square’s market asset is over $105 billion at the time of writing (CNBC, 2021)

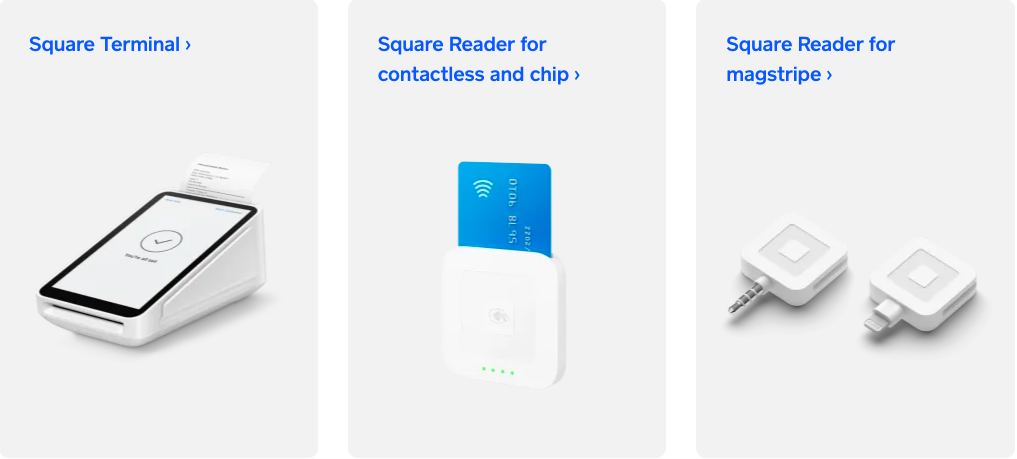

According to CNBC (2021), Square offers the best solution to support individuals to start and grow their businesses by providing a stunning platform to support money transactions. In addition, Square also offers hardware installation for business owners to use the point of sale system (POS), where the system can accept types of payments such as Europay, Master Card, and Visa, just to name a few.

Recently, Pay Now- Pay Later ( BNPL) Afterpay was acquired by Square, Inc for the price tag of around $29 billion USD, as it indicates the ambition of Square CEO and co-founder Jack Dorsey to build Square to become one of the biggest digital online payment platforms, and financial services firms across the globe, which is considered as the biggest business competitor to PayPal, Apple Pay, and others.

2. Square Fees

Moving the next line of Square review is the pricing- depending on what is your business characteristic and needs, the fees will be varied based on the company pricing benchmark. Let’s explore the detail of how many Square charges are based on the different types of payments.

- Using Point of Sale POS to accept or Make a Payment

In case you plan to use a point of sale to make a payment- the payment could be using mobile payment or other compatible devices such as smartphones, desktops, or tablets. Then the flat rate is around 2.5% plus 0.10% for those who would like to use technology to make payments such as a visa, chip card, tapping system, or credit card to make payment.

In addition, the 2.5% flat rate is also applicable to businesses, which plan to install Square’s hardware to accept payment from their customer. Square also offers a discount for businesses to swift to pay a monthly plan, which the rate may be cheaper.

Importantly, the current Square flat rate provides a huge benefit to those who use the higher interchange rates such as American Express (which normally charges a higher fee than other normal credit cards) as it can save users money when using American Express compared with other online payment platforms. Other than that the online payment platform charges the same flat rate for those who wish to use Master Card, Citibank credit card, Visa card

If you have an e-commerce online store to accept the payment, then the fee is a bit higher than the card transactions, which is around 2.8% as the charge rate for online stores is higher than other third-party online payment platforms. However, Square has a solid and better online payment platform to create a better value for the fee the customer pays for.

For those who request to have an invoice on your business transaction, the flat rate would be around 2.9% plus $0.30 on top of the bill.

Card not present transaction: the charge fee is 3.5%+ 0.15 cents, where you use the platform to enter the card manually and use the app to make a payment. Especially, Square will charge a higher fee of 3.5%+0.15 cents for using the card on file transaction, where you keep the card detail in your point of sale, invoices, and virtual terminal.

- Using Square APIs and SDKs to make payments online and in-person

The flat rate is 2.6%+0.10cent for those who use APIs and SDKs to make money transactions- such as using your customer POS system, Coffee Kiosk payment, or any in-person payment for your business

For in-app payment and online payment, the fee will be around 2.9%+0.30 cents based on each transaction using e-commerce.

3. How Does Square Work?

As mentioned earlier, Square is an excellent solution for both small and large businesses to make and receive online payments globally. The payment would be using a credit card such as Citibank Credit bank, a point of sale system, or even using e-commerce for making payments.

In this section, we will review how Square work in order to give our reader direction on how to set up and run the Square payment system in their business.

- The first task is to create your account, which is just within minutes. By filling down the application and clicking the send button on the Square website, the company will send you a confirmation of the application via email.

- After getting accepted as a full member, you are eligible to download Square point of sale system (POS) software as an app on your Apple or Android mobile phones or tablets.

- The next step is to purchase a Square Reader, which uses on both Ipad, and iPhones for your POS system.

- Normally, when a customer makes a purchase through Square reader, you will normally receive the money within 24h.

4. Is Paying with Square Safe?

Square, Inc is a global business company, where it offers a payment solution for big and small businesses to make transactions worldwide. In addition, the company revenue alone in 2020 was over 9 billion dollars due to the fact that it supports millions of money transactions worldwide.

For this reason, Square has been approved for its business license in most of the states of America and other countries by the local authorities.

According to Square’s company statement, security is at the forefront of the company’s innovation, which is considered the solid part to move the company forward to become a global brand. In particular, most of the money transactions using Square hardware and software are encrypted, where your credit card detail and personal information will be protected against any theft/

6. Square Pros and Cons

The next section is to give an overview of Square’s pros and cons based on the above analysis, which gives our readers to make a better decision in choosing the best online payment platform to suit their business needs.

Square’s Pros

- The POS system and technology of Square is the most innovative and easy-to-use platform, no wonder Square VS PayPal are considered the two powerhouses in the digital payment industry.

- As you can see in the pricing section, Square offers an affordable solution with the highest transparency for both small and large businesses to grow their businesses into the next stage.

- There is no monthly fee or annual fee for businesses to use Square as the main payment solution.

- The platform provides the most advanced technology and is friendly to use for its users.

- The platform or POS System can accept offline payment, which means you don’t need to have an internet connection to make a payment using the Square POS system.

Square’s Cons

- The flat-rate pricing is a bit higher for larger businesses as the firm will charge a high fee for a higher number of transactions.

- They don’t accept currencies, which are not included in the company’s operation. In other words, customers can not use Square to make the payment if using local currency, which is not on the currencies list of Square acceptants.

Still haven’t decided what online payment platform works best for your individual and business needs. then you can refer to the related article for exploring more options- Transferwise Reviews: The Complete Review of PayPal Alternative

Don’t forget to share and Join us at Jns-millennial.com for more tips.

By Jiro Nguyen.

The content is only based on the author’s personal opinion and experience. It is for informational purposes only and does not rely on as a comprehensive or substitute for professional advice.